tax credit community meaning

In some systems tax credits are refundable to the extent they exceed the relevant tax. We also go through your credit overview and also advice on when and how much you should use your credit and also aid you to stay on the peak of your progress.

Types Of Financial Statements Bookkeeping Business Learn Accounting Financial Statement

An income tax credit equal to 10 of the annual market rent for the specific qualifying housing unit.

. A tax credit is an amount of money given to a taxpayer by the IRS that reduces their tax bill on a dollar-for-dollar basis. The tax and credit community provides strategies to counter the situation on hand. A tax credit differs from deductions and exemptions.

NerdWallet users get 50 off investigation fees by using the code. UNDERSTANDING TAX CREDIT COMMUNITIES This community is part of the Low-Income Housing Tax Credit LIHTC program. These landlords get to claim income tax credits for.

The program also covers HUD Handbook 43503 guidance that pertains to Low-Income Housing Tax Credit LIHTC properties. There are three types of credits based on this non-refundable refundable and partially refundable credits. The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants.

It does not offer tax credits to the tenant renting the unit. Tenants living in tax credit buildings have good cause eviction protection statewide. A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly.

Well prorate the credit for a unit that is qualified for less than a full year. It does not offer tax credits to the tenant renting the unit. Business credit is crucial for any business as sometimes there might be a need to get a loan or when they need funds to expand.

Regardless of background affiliation or religion. A tax credit is an incentive provided to the taxpayers by the government effectively reducing the total tax paid. Tax Credit Property Definition.

A tax credit may be granted for various types of taxes such as an income tax property tax or VAT. State housing agencies regulate the process to ensure only qualified residents may reside here. Repairing credit needs to take keen eye on positive improvements that counter the negatives.

It may be granted in recognition of taxes already paid as a subsidy or to encourage investment or other behaviors. LIHTC properties may contain market rate units that are not financially assisted in addition to reduced rent LIHTC. The credit can be in the form of a rebate or a direct reduction of the amount.

The termination notice must state good cause and may include either a serious or repeated violation of the. The LIHTC was enacted as part of the 1986 Tax Reform Act and has been modified numerous times. This program is designed to offer affordable housing to only those individuals whom meet specific income requirements.

Its paid for by the federal government and administered by the states according to their own affordable housing needs. The credit cannot be greater than your tax liability. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar.

The bottom line Community Tax covers a wide range of issues but it wont be cheap. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property owners. LIHTC owners are prohibited from evicting residents or refusing to renew leases or rental agreements other than for good cause.

LIHTC properties may contain market rate units that are not financially assisted in addition to reduced rent LIHTC. You may carry forward any unused credits for 5 years. Community Tuition Grant Organization.

A tax credit property is an apartment building owned by a landlord who participates in the federal low-income housing tax credit program. To provide low-income families with tuition assistance and to offset the cost of tuition for parents who would like the option of sending their child to the private school of their choice. Credits are not tax deductions.

3 Tax Credit Eviction. Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide pliability and security for the investors. It is one of the last steps in calculating your annual tax bill and can.

A tax credit is a sum deducted from the total amount a taxpayer owes to the state. The Low-Income Housing Tax Credit is a tax credit for real estate developers and investors who make their properties available as affordable housing for low-income Americans. TCS offers learners a thorough review of IRS regulations and guidance including the IRSs Guide for Completing Form 8823.

The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property owners. Since the mid-1990s the LIHTC program has supported the construction or rehabilitation of about. If you are responsible for tax credit properties whether you are a manager compliance specialist.

To ensure children receive the highest standards of education and to. Tax credit sometimes gets confused with subsidy programs or IZ units or other types of housing but tax credits work a little bit different.

South End Alliance Asset Mgmt South End Mgmt Outdoor Structures

Mcafee Secure Sites Help Keep You Safe From Identity Theft Credit Card Fraud Spyware Spam Viruses And Rent To Own Homes Master Planned Community School Fun

13 Creative Marketing Techniques To Grow Your Small Business A Crafty Concept Marketing Techniques Marketing Business

Reason People Go To The University University Top Funny How To Find Out

Employee Retention Tax Credit Office Of Economic And Workforce Development

The 5 C S Of Borrowing For A Home Real Estate Blog Coldwell Banker Hedges Realty Land Loan The Borrowers Them Meaning

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Borrow The American Way Of Debt Vintage Original The Borrowers Good Books Finance Books

Can A Debt Collector Collect After 10 Years Arrest Your Debt

Low Income Housing Tax Credit Ihda

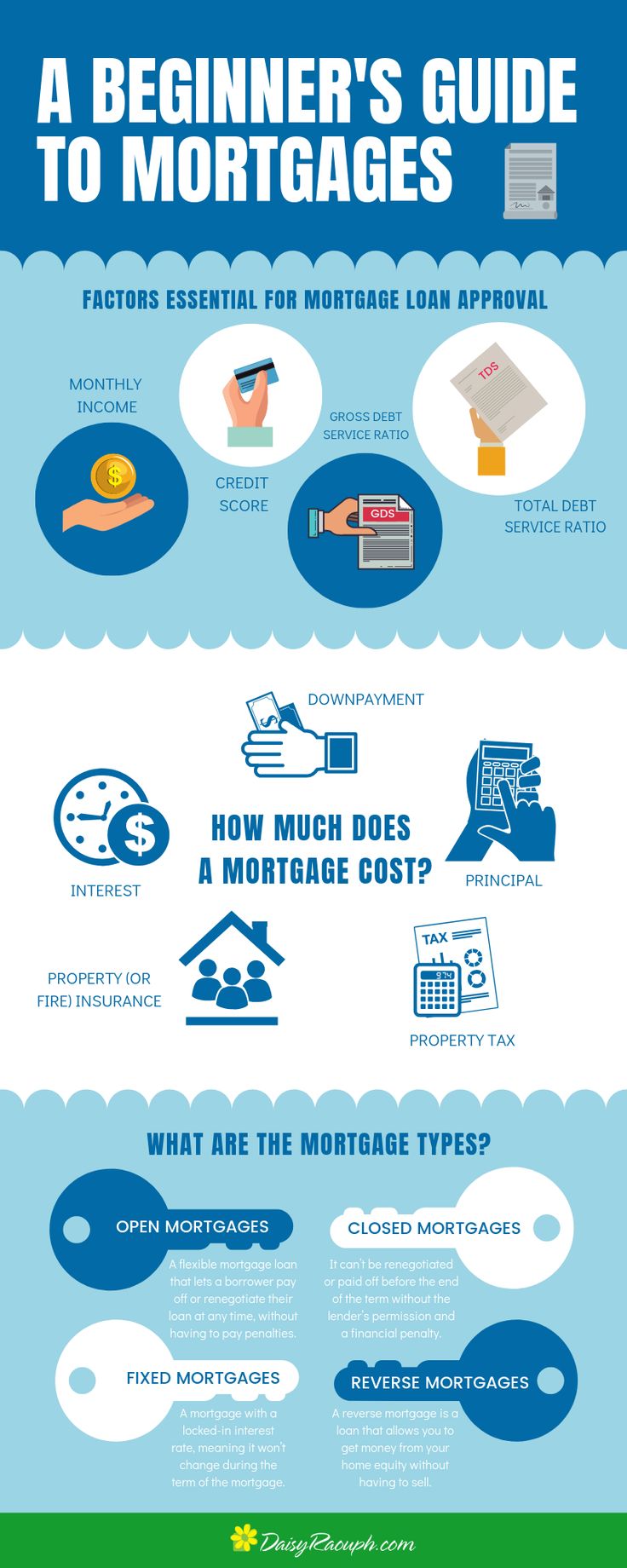

A Beginner S Guide To Mortgages Beginners Guide Mortgage Mortgage Loans

Asset Definition And Meaning Asset English Words Intangible Asset

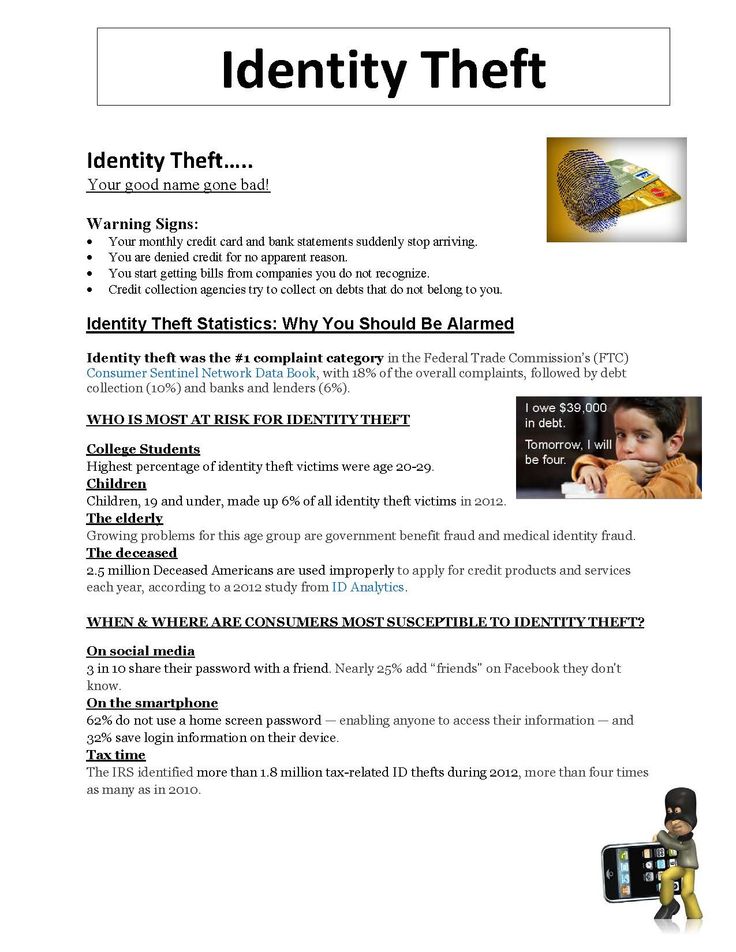

Overview Of Identity Theft From Virginia Credit Union Identity Theft Cool Names Living On A Budget

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Will You Partner With Us To Help Those In Need

Napkin Finance An Intro To Budgeting Budgeting Finance Money Management Advice

/TaxCredit-cd8d4101b88f4d94afcf390b63f1738b.jpg)